colorado electric vehicle tax incentive

2500 to buy or 1500 to lease. Electric vehicle tax credits aims to help low- and middle-income buyers but excludes many vehicles.

Five Things To Look For In Buying An Electric Vehicle For Below 50k The Hill

Direct Current Fast Charging DCFC Plazas Program.

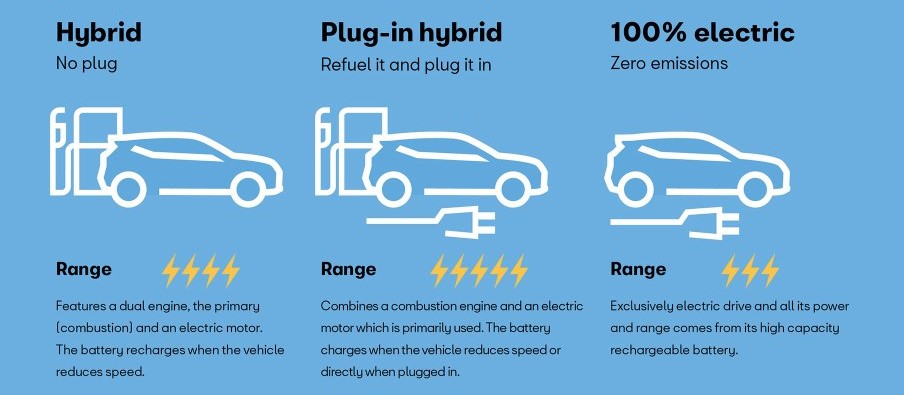

. Qualified EVs titled and registered in Colorado are eligible for a tax credit. Light duty electric trucks have a gross vehicle weight rating GVWR of less than 10000 lbs. Plug-in hybrid electric vehicles PHEVs.

The bill also includes up to a 4000 tax credit for used electric vehicles which were previously not eligible. Some dealers offer this at point of sale. If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69.

Medium duty electric trucks have a GVWR of 10000 pounds to 26000 pounds. The tax credit for most innovative fuel vehicles is set to expire on January 1 2022. Tax credits are available in Colorado for the purchase lease and conversion of light medium and heavy duty alternative fueled vehicles electricEV plug-in hybrid or PHEV compressed natural or CNG liquefied natural gas or LNG liquefied petroleum gas or LPG and hydrogen These credits were simplified effective Jan.

Monday August 31 2020. Colorado EV Incentives for Leases. Rivians vehicles over 80000 will immediately lose access to the tax credit as will those of Fisker whose soon-to-be-released Ocean electric vehicle is assembled in Austria.

Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle. Up to 7500 in federal tax credit. The bill also adds some new restrictions on who.

Electric Vehicle EV Tax Credit. Electric Vehicle EV and EV Charging Station Grants. Experts say the bills electric vehicle tax credits - up to 7500 for a new EV and 4000 for.

Electric Vehicle EV Tax Credit. While Colorado does not have an electric vehicle rebate the state offers tax credits for the purchase or lease of an electric vehicle EV of up to 3500. Light-duty EVs regular EV cars.

The Xcel Energy rebates come as the value of Colorados electric vehicle tax incentive has shrunk. Information on tax credits for all alternative fuel types. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

The current iteration offering up to 5000 in tax credits dropped to 4000 in January and will be reduced again to 2500 next year. The Inflation Reduction Act will eliminate the 200000-vehicle cap that prevented buyers of popular electric vehicle companies like Tesla and General Motors from receiving the credit. Light-duty EVs purchased or leased before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year.

Light-duty EVs purchased or leased before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year. Tax credits are as follows for vehicles purchased between 2021 and 2026. Titled and registered their vehicle in Colorado.

Impact Assistance Program for Public Fleets. Colorado has offered some form of alternative fuel rebates or tax credits since 1992. Get information about state and federal Tax Credits and learn about how to apply these credits toward your future EV.

General Motors to Sign onto Colorado Electric Vehicle Program Making 4000 Tax Credit Immediately Available for Purchasers. Electric Vehicle EV Tax Credit. Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year.

2500 for a new EV or 1500 for a 2 year lease. DENVER - General Motors GM has informed state officials that the auto company will begin using Colorados assignability provisions of the Colorado Innovative Motor Vehicle Tax Credit effective immediately. If you decide to purchase a new EV or EV truck let Jerry help you save even more money.

Electric Vehicle EV and Infrastructure Coaching Service. Hybrid electric vehicles HEVs. The state of EV incentives.

The table below outlines the tax credits for qualifying vehicles. State andor local incentives may also apply. Learn about the variety of electric vehicle models and the discounts you can take advantage of from trusted dealerships around Colorado on our EV Deals page.

CO State Tax Credit. The original 5000 tax credit was one of the countys most generous when it went into effect. Additionally the Colorado Colorado Department of Revenue only offers this incentive to qualified individuals who have.

Vehicles with a replaced power source that use an alternative fuel. Qualified EVs titled and registered in Colorado are eligible for a tax credit. Colorados National Electric Vehicle Infrastructure NEVI Planning added 6142022.

The credits decrease every few years from 2500 during January 2021 2023 to 2000. Small neighborhood electric vehicles do not qualify for this credit but they may qualify for another credit. The State of Colorado offers an income tax credit for the purchase or lease of an electric motor vehicle a plug-in hybrid motor vehicle or an original equipment manufacturer electricplug-in hybrid electric truck.

Purchased or converted their vehicle. 5500 for income qualified customers. The credit amount will vary based on the capacity of the battery used to power the vehicle.

Electric Vehicle Charging Rebates Electric Vehicle Charging Ev Charger Electricity

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Manchin Bill Tesla Electric Car Tax Credit May Be Limited Bloomberg

States Used To Help People Buy Electric Cars Now They Punish Them For It Electric Cars Hybrid Car Electric Car Conversion

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Ustr Backs Efforts To Strengthen U S Ev Industry Despite Objections Reuters

How Do Electric Car Tax Credits Work Credit Karma

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Why Are So Many Electric Cars Still Only Sold In California

A Complete Guide To The Electric Vehicle Tax Credit

Popular Mechanics Ev Awards Best Electric Vehicles 2021

Get A New Nissan Leaf As Low As 11 510 After Incentives In Kansas Or Missouri Nissan Leaf Nissan Family Car

All About Electric Vehicles De Co Drive Electric Colorado

Electric Vehicle Incentives By State Polaris Commercial

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Democrats Walk Tightrope In Push For Electric Vehicles The Hill

Manchin Sets High Bar For Tesla And Gm Electric Car Tax Credits Bloomberg

Car Charging Company Is On A Tear Buying Ge Stations Securing Investments Ev Charging Battery Powered Car Ev Charging Stations